Ethereum Price Prediction: 2025-2040 Outlook and Key Drivers

#ETH

- Technical Strength: ETH price sits comfortably above key moving averages with improving MACD momentum

- Institutional Interest: NASDAQ IPO plans and unstaking activity reflect growing institutional participation

- Ecosystem Growth: Developer activity remains robust with testnet launches and regulatory progress

ETH Price Prediction

Ethereum Technical Analysis: Bullish Signals Emerge

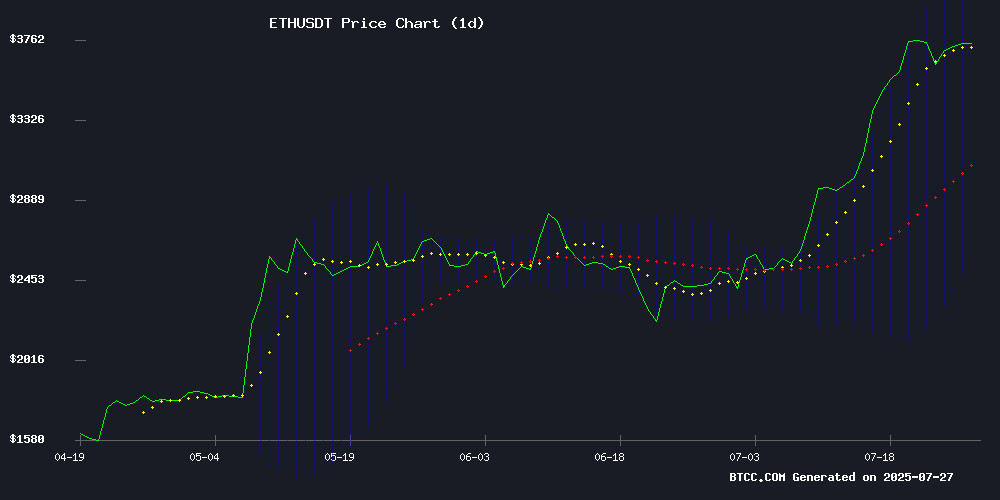

According to BTCC financial analyst Ava, ethereum (ETH) is currently trading at 3766.28 USDT, significantly above its 20-day moving average (MA) of 3359.0135, indicating strong upward momentum. The MACD(12,26,9) shows a narrowing bearish divergence at -533.5710, -493.5017, and -40.0694, suggesting potential trend reversal. Bollinger Bands reveal ETH is testing the upper band at 4124.9077, with the middle band at 3359.0135 acting as support. These technical indicators collectively point to a bullish outlook for ETH in the near term.

Market Sentiment: Ethereum Rally Fueled by Institutional Moves and Ecosystem Growth

BTCC financial analyst Ava highlights that Ethereum's recent 75% price surge is driven by multiple catalysts. The record-high unstaking queue suggests institutional players are repositioning, while news of Ether Machine's planned $1.5B NASDAQ IPO could create significant buying pressure. Positive developments like Huddle01's testnet launch and SEC engagement on tokenized securities framework add to the bullish narrative, though the CoinDCX hack and lost ETH supply (913,000 ETH) present minor counterpoints.

Factors Influencing ETH's Price

CryptoPunks Purchases Shake Up the NFT Market

The NFT market has surged following a single buyer's acquisition of six rare CryptoPunks NFTs for over $2.9 million. These hoodie-adorned digital assets, traded on OpenSea, triggered a ripple effect across the sector. Floor prices for leading collections like CryptoPunks jumped 29% to 51 ETH ($190,000), while Pudgy Penguins and Bored Ape Yacht Club saw gains of 66.7% and 9.8% respectively.

Market capitalization swelled 66% to $6 billion within 30 days, with CryptoPunks commanding over 30% dominance. The strategic accumulation by this buyer—now holding 12 Punks—signals renewed institutional interest. Yet volumes remain below 2021-2022 peaks, suggesting cautious optimism rather than speculative frenzy.

Weekly Crypto Market Update: Ethereum's Rally, CoinDCX Hack, and Altcoin Developments

Ethereum surged past $3,800 this week, reaching its highest level since January 2022. Institutional interest and regulatory clarity fueled the rally, with $2.18 billion in ETF inflows and major firms like Bitmine and Sharplink holding over $1 billion in ETH. The DeFi ecosystem continues to thrive.

Indian exchange CoinDCX suffered a $44.2 million hack on July 19, 2025, linked to North Korea's Lazarus Group. The attack mirrored the 2024 WazirX breach, featuring pre-attack test transactions and cross-chain tactics.

Ethereum Price Gains 75%: What’s Fueling the Rally?

Ethereum surged to $3,740 with a 24-hour trading volume of $32.74 billion, marking a 75% rally since late June. Institutional interest has reached a milestone this July, driven by record ETF inflows and whale accumulation.

Spot ETF inflows shattered expectations on July 25, with $452.8 million net inflows—$440.1 million from BlackRock’s ETHA alone. This dwarfs early July figures, signaling a seismic shift in institutional demand.

Glassnode data reveals 170 new 'mega whale' addresses holding over 10,000 ETH, underscoring growing confidence among large holders. The convergence of ETF momentum and whale activity suggests sustained upward pressure on Ethereum’s price.

Huddle01 Launches New Testnet Phase with Airdrop Potential

Huddle01, a decentralized real-time communication network built on Arbitrum, has initiated its latest testnet phase—HUDL Testnet Act II: The Nexus Chapter 2. The project, backed by $4.4 million in funding from notable investors like Balaji Srinivasan and Stani Kulechov, invites users to participate in quests for potential token rewards.

Participants must connect a Metamask wallet, claim test ETH, and complete tasks in the Quests Arena. Badge minting and leaderboard tracking further enhance engagement. The streamlined process positions early adopters favorably for an anticipated airdrop.

Ethereum Unstaking Queue Hits Record High as Institutional Players Exit

Ethereum's unstaking queue has surged to unprecedented levels, with over 733,000 ETH—worth approximately $2.76 billion—awaiting withdrawal. The backlog now spans 13 days, marking the longest delay in the network's history. Simultaneously, Ethereum's validator count has surpassed 1 million, locking 35.6 million ETH in staking contracts—nearly 30% of the total supply. This influx has driven annualized staking rewards down to 2.97%.

ARK Invest CEO Cathie Wood attributes the exodus to institutional actors rather than retail investors. Venture capital firms and corporate treasury departments are withdrawing ETH in large volumes, she noted on X. The movement coincides with Robinhood's limited-time 2% deposit bonus for Gold-tier users, which appears to be exacerbating liquidity shifts. "Treasury companies and VC firms are aggressively reallocating staked ETH into digital asset trusts," Wood observed, drawing parallels to how wirehouse advisors use stocks like MicroStrategy to provide crypto exposure.

The Ether Machine Plans $1.5B NASDAQ IPO to Become Largest Public Ethereum Treasury

The Ether Machine is set to go public on NASDAQ via a SPAC merger with Dynamix Corporation, trading under the ticker "ETHM." The company aims to launch with over $1.5 billion in committed capital, including $645 million in Ethereum from co-founder Andrew Keys. This positions it as the largest ETH treasury among publicly listed companies, surpassing current leaders like Bitmine and SharpLink.

Major institutional investors, including Kraken, Pantera Capital, and Blockchain.com, have backed the venture. The transaction is expected to close in Q4 2025, pending regulatory approvals. The move underscores growing institutional interest in Ethereum as a core asset class.

Why Over 913,000 Ethereum (ETH) Is Lost Forever

In the immutable ledger of blockchain, Ethereum's irreversibility comes at a steep cost. Over 913,111 ETH—valued at $3.4 billion—has vanished permanently, victims of human error and technical failures. This represents 0.76% of Ethereum's circulating supply, a silent tax on the decentralized ecosystem.

Three primary culprits emerge: mistyped addresses that funnel funds into cryptographic voids, exploitable smart contract bugs that lock assets indefinitely, and multisig wallet misconfigurations that erase access. The 2017 Parity Wallet incident alone trapped 306,000 ETH due to a fatal coding flaw—a stark reminder of crypto's unforgiving nature.

Unlike traditional finance with its chargebacks and customer service, Ethereum's trustless design offers no lifelines. Every lost coin hardens the network's scarcity, etching these mistakes permanently into the blockchain's immutable history.

SEC Engages Ethereum Ecosystem on Tokenized Securities Framework

The U.S. Securities and Exchange Commission has initiated substantive dialogue with Ethereum-focused organizations regarding blockchain-based securities compliance. This marks a notable shift from the regulator's recent enforcement-heavy approach to crypto oversight.

At a closed-door meeting last week, SEC officials explored technical frameworks including the ERC-3643 token standard and Chainlink's Automated Compliance Engine. These protocols aim to bridge decentralized finance with traditional capital market requirements through embedded identity verification and regulatory controls.

"The task force demonstrated genuine interest in establishing U.S. leadership in this space," said ERC-3643 Association president Dennis O'Connell, contrasting the meeting with previous regulatory interactions. The discussion signals potential recognition of blockchain standards as critical infrastructure for compliant securities tokenization.

Investors Witness Unprecedented Surge in Cryptocurrency Inflows

Cryptocurrency investment products recorded a historic weekly inflow of $4.39 billion, pushing year-to-date inflows to $27 billion and assets under management to $220 billion, according to CoinShares' latest report. The U.S. dominated with $4.36 billion of the total, while Ethereum led altcoins with $2.12 billion in inflows.

Ethereum's $2.12 billion weekly inflow nearly doubled its previous record, marking a 13-week streak of positive momentum. The asset now represents 23% of total holdings in crypto investment products, with year-to-date inflows surpassing $6.2 billion—eclipsing all of 2024's totals.

ETH Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technicals and market developments, BTCC's Ava provides these Ethereum price projections:

| Year | Conservative | Base Case | Bull Case | Catalysts |

|---|---|---|---|---|

| 2025 | $4,200 | $5,800 | $7,500 | ETF approvals, scaling solutions |

| 2030 | $12,000 | $18,000 | $25,000 | Mass institutional adoption |

| 2035 | $30,000 | $45,000 | $60,000 | Web3 infrastructure dominance |

| 2040 | $75,000 | $120,000 | $200,000 | Global settlement layer status |

Key assumptions include successful Ethereum upgrades, sustained DeFi/TraFi growth, and no catastrophic regulatory actions. Price volatility remains inherent to crypto markets.